How to Complete Form I-9 Section 1: Employee Identification and Verification

How to Complete Form I-9 Section 1: Employee Identification and Verification

Form I-9 is Required

Every employer must complete a Form I-9 each time it hires any person to perform labor or services in the United States in return for wages or other remuneration. This requirement applies to everyone hired after November 6, 1986.

Employees complete Section 1 of Form I-9 when they begin work. The employer certifies its review of the employee's work authorization documents in Section 2 of Form I-9 within 3 business days of the first workday. If the employer hires a person for less than 3 business days, Sections 1 and 2 of Form I-9 must be fully completed when the employee begins work.

Form I-9 Exceptions

The employer does not complete a Form I-9 for persons who are:

(1) Hired before November 7, 1986, who are continuing in their employment and have a reasonable expectation of employment at all times;

(2) Employed for casual domestic work in a private home on a sporadic, irregular, or intermittent basis;

(3) Independent contractors; or

(4) Providing labor for the employer who are employed by a contractor providing contract services (e.g., employee leasing or temporary agencies);

(5) Not physically working on U.S. soil.

Forms I-9 employment eligibility verification and employer sanctions law compliance is the Employer’s Responsibility.

It is unlawful for any employer to "knowingly hire or continue to employ" unauthorized workers. Actual knowledge that the worker is not employment authorized is not required to establish employer liability. Employers are liable for "constructive knowledge" that an employee is not authorized for employment. "Constructive knowledge" may be fairly inferred if through the exercise of reasonable care a person should or would have known that the employee was not authorized for employment; or the employer deliberately fails to investigate the facts.

It is critical that not only the company’s Employer Sanctions Compliance Manager (often an "HR supervisor" or "bookkeeper" thoroughly understands not only how to properly complete Forms I-9, but also that company owners, executives, managers, and supervisors understand lawful Form I-9 employment eligibility verification practices and procedures. Companies and individuals face civil fines and criminal penalties, including imprisonment if their Forms I-9 documents are not properly completed, and retained.

Form I-9 Advance Planning

Every company needs to have one person in charge of ensuring the Forms I-9 are properly completed and stored n a manner allowing them to be retrieved within 3 days in the event of a Notice of Inspection, i.e., the Employer Sanctions Compliance Manager. Having an Employer Sanctions Compliance Manager, a written policy, and a compliance plan concerning Forms I-9 that establishes “Review Guidelines” will go a long way to avoid extreme financial and emotional cost when a Notice of Inspection is received.

This person or his/her agent must be available to personally witness the employee complete Form I-9 Section 1 and view the original documents presented by the employee. This is often the Human Resource Manager or another person responsible for hiring and training employees.

Section 1—Employee Information and Verification

The employee completes Section 1 by filling in the correct information and signing and dating the Form I-9. Ensure that the employee prints the information clearly.

If the employee cannot complete Section 1 without assistance or if s/he needs the Form I-9 translated, someone may assist him/ her. That preparer or translator must read the Form I-9 to the employee, assist him/her in completing Form I-9 Section 1, and have the employee sign or mark the form in the appropriate place. The preparer or translator must then complete the Preparer/Translator Certification block on Form I-9.

The employer is responsible for reviewing and ensuring that the employee fully and properly completes Section 1.

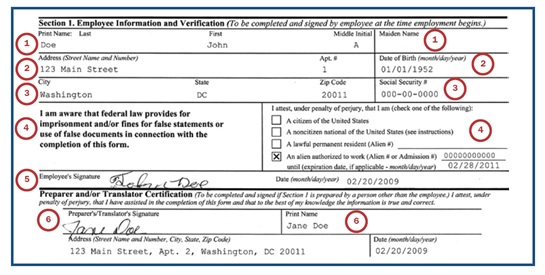

Figure 1: Instructions for Completing Section 1: Employee Information and Verification

Employee enters full name and maiden name, if applicable. Employee enters full name and maiden name, if applicable.

Employee enters current address and date of birth. Employee enters current address and date of birth.

Employee enters his or her city, state, ZIP Code, and Social Security number. Entering the Social Security number is optional unless the employer verifies employment authorization through the USCIS E-Verify Program. Employee enters his or her city, state, ZIP Code, and Social Security number. Entering the Social Security number is optional unless the employer verifies employment authorization through the USCIS E-Verify Program.

Employee reads warning and attests to his or her citizenship or immigration status. Employee reads warning and attests to his or her citizenship or immigration status.

Employee signs and dates the form. Employee signs and dates the form.

If the employee uses a preparer or translator to fill out the form, that person must certify that he or she assisted the employee by completing this signature block. If the employee uses a preparer or translator to fill out the form, that person must certify that he or she assisted the employee by completing this signature block.

Minors (Individuals Under Age 18)

If a minor, a person under the age of 18, cannot present a List A document or an identity document from List B, the Form I-9 should be completed as follows:

(1) A parent or legal guardian must complete Section 1 and write “Individual under age 18” in the space for the employee’s signature;

(2) The parent or legal guardian must complete the “Preparer/Translator Certification” block;

(3) The employer will write “Individual under age 18” in Section 2, under List B; and

(4) The minor must present a List C document showing his/her employment authorization. The employer should record the required information in the appropriate space in Section 2.

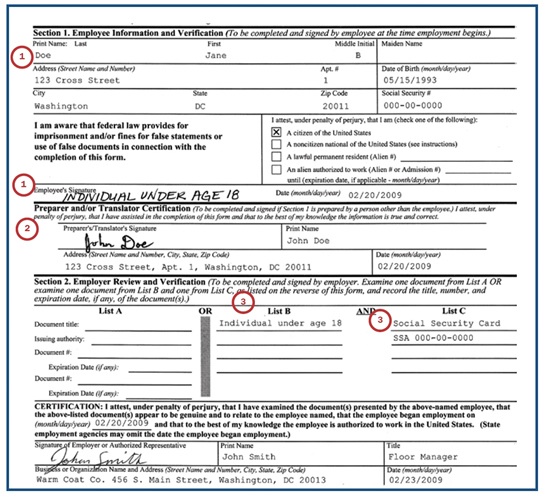

Figure 3: Completing Form I-9 for Minors

A parent or legal guardian of a minor employee completes Section 1 and writes, “Individual under age 18” in signature space. A parent or legal guardian of a minor employee completes Section 1 and writes, “Individual under age 18” in signature space.

A parent or legal guardian completes the Preparer and/or Translator block. A parent or legal guardian completes the Preparer and/or Translator block.

Enter “Individual under age 18” under List B and records the List C document the minor presents. Enter “Individual under age 18” under List B and records the List C document the minor presents.

Employees With Disabilities (Special Placement)

If a person with a disability, who is placed in a job by a nonprofit organization, association, or as part of a rehabilitation program, cannot present a List A document or an identity document from List B, complete Form I-9 as follows:

(1) A representative of the nonprofit organization, a parent or a legal guardian must complete Section 1 and write “Special Placement” in the space for the employee’s signature;

(2) The representative, parent or legal guardian must complete the Preparer/Translator Certification” block;

(3) The employer will write “Special Placement” in Section 2, under List B; and

4; (4) The employee with a disability must present a List C document showing his/her employment authorization. The employer should record the required information in the appropriate space in Section 2.

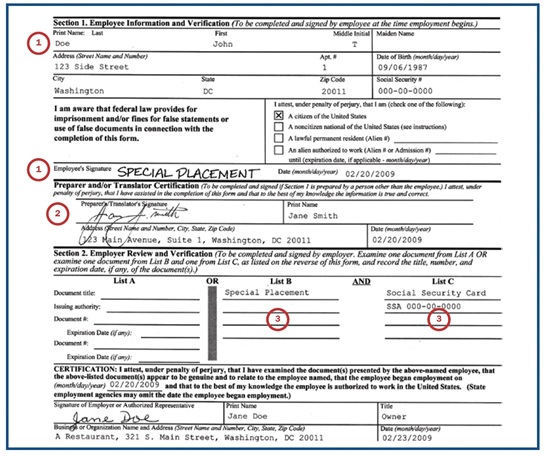

Figure 4: Completing Form I-9 for Employees with Disabilities (Special Placement)

A representative of a nonprofit organization, parent or legal guardian of an individual with a disability completes

Section 1 and writes, “Special Placement” in signature space. Section 1 and writes, “Special Placement” in signature space.

The representative, parent, or legal guardian completes the Preparer and/or Translator block. The representative, parent, or legal guardian completes the Preparer and/or Translator block.

Enter “Special Placement” under List B and records the List C document the employee with a disability presents. Enter “Special Placement” under List B and records the List C document the employee with a disability presents.

|